I was talking to a friend in anguish over how to sell his medical practice.

He seemed to be going around in circles with all the possible objectives and options.

Should he simply sell the hard assets and close? Should he bring in some young associates and prepare them to take over the practice for the next three years? Did he want to wait that long? Should he sell to another doctor who wanted to increase his client base? Could he trust that his patients would be well cared for if he sold to a third party?

Lots of questions!

He needed a basis for clarifying his options so that he could make sound decisions.

Business owners who’re considering selling have to see the choices that drive their exit plan. Otherwise, all the possible strategies and options can become overwhelming, and the owner will get frustrated, anxious and stuck.

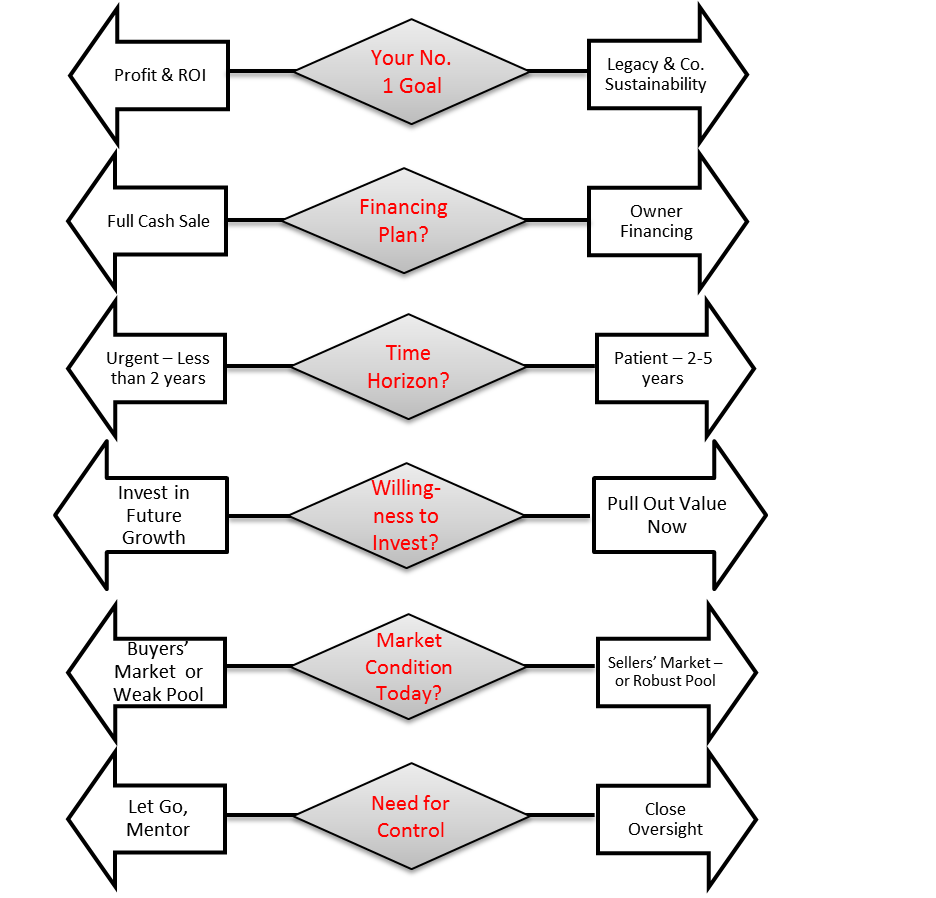

Each of the six questions below is a key factor in determining which strategy will be right for you. These aren’t simple yes/no questions; each one is a continuum. Each end of the continuum helps you consider the key choices you’ll have to make in order to form a clear exit strategy.

1. What’s Your Ultimate Goal?

What’s your over-riding goal in selling your business? Is it to get the highest return on your investment/equity i.e. a big profit? Or, is it to leave a legacy and a sustainable business that endures beyond your ownership?

This isn’t to say you can’t do both, but you must get very clear on your first priority. This pivotal question will start to define which selling strategy makes sense and which will be a less successful fit.

2. How Will the Deal Be Financed?

How will the sale be funded? Are you willing to do seller financing (few sales of small businesses do not involve owner financing)? Will you take a phased pay out or cash out?

3. What’s Your Time Frame?

How urgent is it that you sell your business? Do you have a patient horizon of 3-5 years or is this a faster cycle of less than 2 years? Why does this matter? Because the buyer options are different in a fast cycle sale.

4. What’s Your Willingness to Invest in Your Business?

What’s your willingness and ability to invest in increasing the value of your business either by shaping it up (operations, systems, processes, facilities), investing in bench strength, or growing revenues?

5. What are the Market Conditions?

What’s the state of the economy, of capital markets, of your industry; and, how robust is the pool of potential buyers? This may require some input from a business sales broker or from your industry association or other resources like the Federation of Independent Business Owners or the US Small Business Association.

6. Are You Really Ready To Let Go?

Do an honest assessment of your willingness to let go of control, to relinquish the reins and step away from your involvement in the business.

Are you ready to divest power, play a different role such as mentor/coach, be the ambassador whose picture is on the wall? Or do you feel you need to stay engaged in the day to day, the customer relationships, the revenue generation because it’s just too risky to let go (regardless of the time frame you may have set in #4).

Using the continuum below mark what you are thinking about each of the six questions most on owners’ minds. But beware! Marking your answers down the middle does not bring clarity or reduce anxiety. Push your thinking to declare a preference.

And my friend the doctor? He has a clearer idea of the his time horizon and the consequences of his answers to the six questions. He is now figuring out the planning he needs to do to realize his priorities.

Now it’s Your Turn: What were your insights? What still puzzles you? Leave a comment or question below.