Worried about the costs of bringing in expensive “experts”?

There’s the lawyer, the broker, the CPA…

To safely and effectively sell your business you need in-depth knowledge of your company and the understanding of very narrow technical fields like estate and financial planning, business valuation, legal entity agreements, financial audits and employee retention.

And since you can’t be an expert in all of these areas, you’ll want to get yourself a Pit Crew.

Visualize the Pit Crew at a top NASCAR race. Each member performs a unique specialty, yet together they create the exact results needed right there in the pit stop. They’re experts at that task and at the teamwork required to deliver incredibly important results.

You Can Minimize Costs with Three Simple Rules

Drive Coordination & Provide Autonomy

Like a Pit Crew, your advisors must have autonomy but must also work together to help you build the strongest executable plan. That means they need —

- to know your long term goals and your timeline for your exit;

- to know their roles and your expectations for how they work together and with you; and

- the freedom to use their expertise with clear accountability for delivering solutions that meet your goals, schedule and budget.

What happens when Advisors are missing these three? Time, money and opportunity are wasted.

An owner of a micro business in my town had his attorney draft a sales agreement with a prospective buyer based on their one-on-one meeting. It was a thorough document which seemed to incorporate the owner’s objectives, terms and considerations.

The owner then took it to his CPA who declared it to be “totally wrong” based on the CPA’s understanding of the owner’s financial picture and goals. The lawyer was focused on minimizing the owners’ liability exposure; the CPA on tax considerations. Rather than put the two of them together to find the optimal solution (and hear their individual concerns about the overall ‘deal’), the frustrated owner abandoned her lawyer to avoid “more wasted money.”

After many months, the deal fell through–over the very issues raised separately, but never resolved, by the two advisors.

Avoid “One Man Shows”

Don’t fall into the trap of expecting a single advisor to be your one-stop shop. It may be tempting to call in your CPA or legal counsel as your only guide. You trust them; they already have a sense of your business; and they’re already in the budget.

But it’s impossible for one advisor to be fully experienced in all the selling issues. Remember, you’ve got market variables, pricing and competitive benchmarking, estate or financial planning, cost structures and growth strategies and preparing your people for a transition — just to name a few!

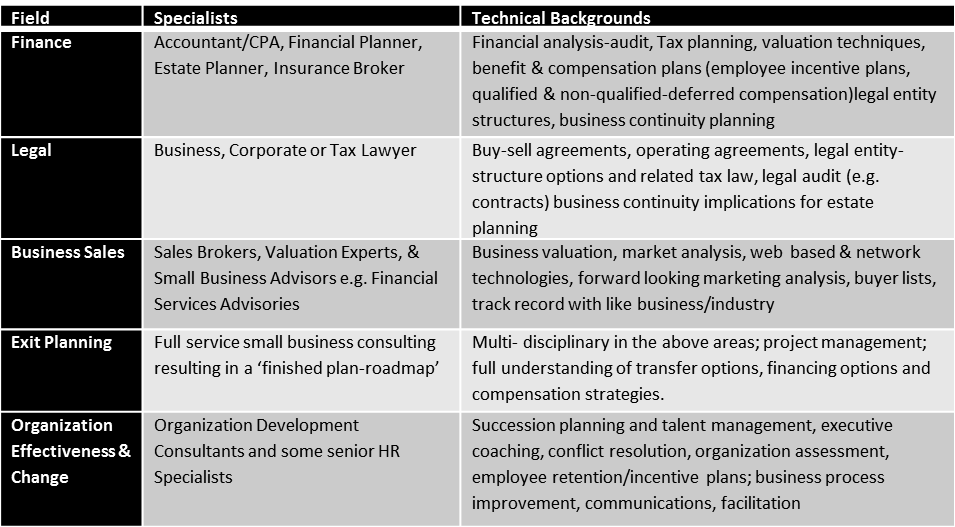

The table below describes a list of advisors and what they bring to your exit planning. Who are the critical few that will support building and executing your strategy?

Start Work Early

Some of the technical work with advisors happens far in advance of leaving your business. For example, you’re probably counting on the proceeds from the sale of your business to fund your retirement. Estate planning, writing or updating legal operating and buy-sell agreements, and financial planning should occur years before you put your business on the market.

Have you put in place the documents that support that objective? Here’s what percent of business owners of privately held companies/firms have in place (and it’s not all good news):

- Estate Plan – 64%

- Key person insurance – 58%

- Formal financial plan – 43%

- Buy‐sell agreements – 38%

If you’ve done the up-front planning, how current is it? Don’t fail to review and update these every couple of years. The consequences of outdated legal documents are the horror stories of partner/shareholder lawsuits, failed buyouts, and even forced bankruptcy.

The statistics are grim regarding the average number of years since updates:

- Estate Plan – 12.8 years

- Buy‐sell agreement – 12.4 years

- Key person insurance – 10.6 years

Significant advisory work also occurs within the year or two of a sale. You’ll want to pay attention to:

- valuation,

- family business transfer plans,

- communication planning,

- reconciling and cleaning up financial records and

- ensuring healthy balance sheets.

Be sure you budget your time and dollars for this work.

Do you have the right set of advisors?

Are they all on the same page about their roles and deliverables, and can they work well together?

Have you planned to involve them early enough on the critical path that will ensure you have the most options in building your exit strategy?

Do you have the mindset and patience to lead, to listen to and, to trust your advisors’ expertise?