I’m speaking soon to a group of business advisors about helping their clients gain a sense of urgency about exit planning, since only about 15 percent of business owners have a written plan. I was asked to be sure to think about the role of insurance.

Insurance!? I couldn’t imagine a drier subject I know less about. Isn’t insurance what we all hate to buy, and yet, we can’t drive a car or get a mortgage without? Isn’t it at the heart of the debate between Republicans and Democrats who vote on health care bills neither seems to have studied?

Not that the topic hasn’t been very much in my focus recently. The recent huge wildfire behind our home and, more simply, driving around on errands, made it relevant. Nothing like watching a fire headed for your home to wonder if you have the right coverage – even though it’s a bit late to worry then. As for driving, it’s spring, and you can bet on road potholes. But I have good auto insurance coverage and a tire warranty for these hazards – don’t I?

Facing the challenge of the topic, I decided to consult some experts. I also headed to the internet to see what I could learn and find compelling to talk about. Before too many clicks I realized:

- It’s complex. My searches produced over 10 million results and over 25 varieties of insurance owners might need, before I gave up.

- It’s really important. Some 25 percent of businesses that shut down after a natural disaster never reopen. Lack of insurance protecting the business and people is one reason.

- Boomer owners’ insurance knowledge is often woefully out of date, resulting in decisions that negatively impact business value in a sale.

- Owners have the wrong focus. Owners (and too often their advisors) focus on products and coverage (i.e., how can I get the most for the least), not risk management and company value.

A Complex World Has Changed the Basics

Traditionally, the four risk areas that most business people are aware of and look to insure are:

- Physical and environmental hazards: Fire, flood, natural disasters, toxic contamination, etc.

- People: From health to disability to layoffs and even criminal behavior on-site

- Loss and liability: Retailers and manufacturers know this as inventory shrinkage; restaurants and bars protect against fake IDs and alcohol over-service, for example, as well as those slippery floors

- Compliance: Regulatory requirements like safety, product labeling, and industry specific regulations

In a more complex world of technology, global markets, government regulation, and changing demographics, additional critical factors impact a company’s bottom line and financial security. Far fewer of us understand these factors or their importance:

- Day-to-day operational procedures

- Technology

- Key talent retention and replacement

- Financial reporting & liability

- Global expansion

- Overall governance

One factor from this list has made recent headlines: the failure of day-to-day operations of United Airlines’ policies and practices for the “re-accommodation” of a passenger. Technology provides a second newsworthy example. Recall the 2013 Target data breach that affected 62 million cardholders’ personal data and resulted in: $252 million in costs; a 3-4% decline in sales transactions; a CEO resignation; a 1,700-employee layoff; and a profit decline of 46% in the immediate aftermath.

Those are some big potholes!

Typical Potholes That Impact Company Sale Value

Many risk areas significantly impact business value when it comes to transferring ownership. Here are three that advisors typically see:

Ineffective buy-sell agreements: Test yourself on the basic effectiveness of your agreement. Does the agreement reflect current company value; is it adequately and correctly funded? Has it been reviewed to ensure it meets the needs of your current owners and circumstances since its initial drafting?

Unfunded liabilities such as deferred compensation plans: When there are no assets funding the plan, a shortfall can produce a significant hit to the company balance sheet and may reduce an owner’s equity in the business. Have you reviewed your risk in this area with your key advisors?

Lack of key-person insurance or compensation structures: These protect against death of owners and key executives or employees. (Most owners know this as key-man insurance.) But most owners are unaware that you can, in fact, use insurance to retain key talent too; for example, a company provides a time-based retention bonus funded with life insurance as part of a non-qualified deferred compensation plan. (But frankly, it’s company practices and culture that promote retention and commitment.) Good advisors look to and beyond insurance in helping their clients see the risks to competitive advantage and value growth.

And isn’t that what we owners need – a deep conversation with our advisors about business risks and the options for risk management and value protection? Instead of a hammer in search of a nail, we must look at our business with a toolbox, or even a whole hardware store!

Have the Right Discussion

That’s the heart of what I learned in my research: Owners and advisors must focus less on products and coverage and more on risk management and company value. What are the most important risks to the value of my business and my people that must be managed – and with what solutions?

That’s the heart of what I learned in my research: Owners and advisors must focus less on products and coverage and more on risk management and company value. What are the most important risks to the value of my business and my people that must be managed – and with what solutions?

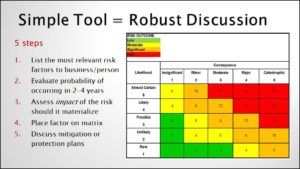

One way to focus on risk and value is to use a simple tool, shown here. By following the steps with a key advisor, a business owner can learn:

- Whether there is a gap in information needed to make the risk/impact assessment

- What risks/concerns an owner can live with and stop losing sleep over

- Which few urgent issues require action

Not all risks require insurance products. But all risk, if poorly managed, has an impact on the value of a company and an owner’s equity down the road.

Have you had this critical conversation with your advisors?