You have three goals in selling your business: profit—a return on all that passion and investment; pride in what you built; and a legacy that others can build upon. Your Exit Strategy helps you achieve those goals, but it takes your leadership to assure them. Your leadership paves the road that you, your people, and your buyer will use to move forward into the next phase. That road can be smooth and well-marked or filled with potholes and detours. How you lead the transitions of your exit determines what the ride will be like.

What’s the Destination in Leading Exit Transitions?

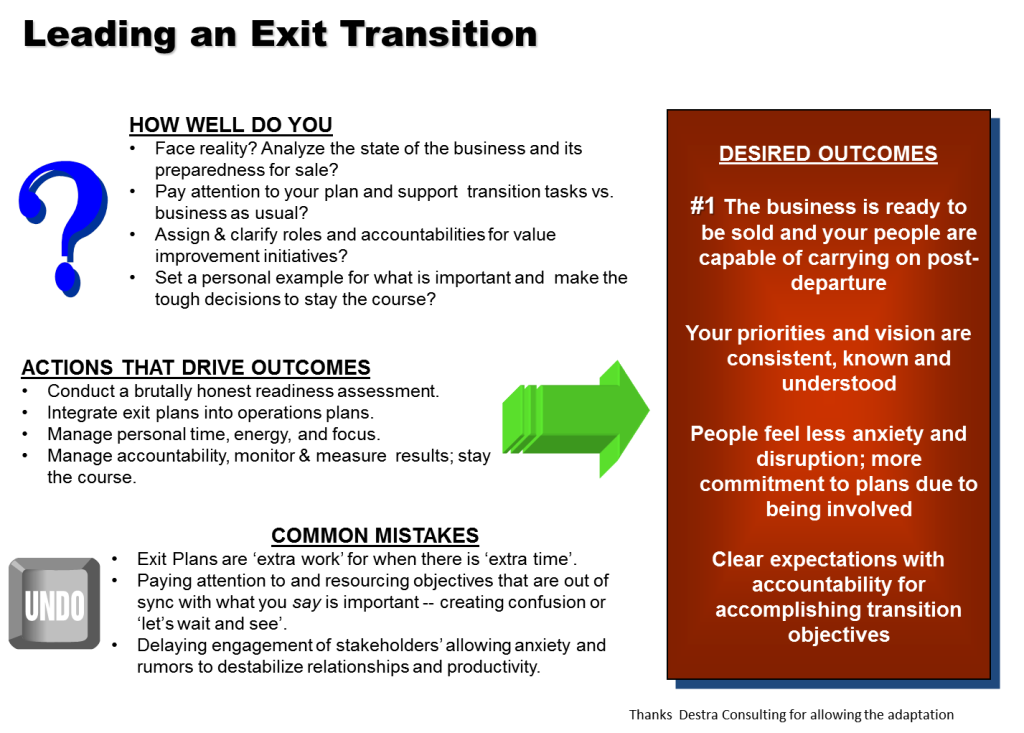

#1 Your business is ready to be sold, and your people are capable of and committed to carrying on after you leave.

The following conditions help you arrive at # 1 above.

- Your priorities and vision for the company and your exit are known and understood by your key stakeholders.

- There are clear expectations with accountability for accomplishing transition objectives.

- There is sustained commitment to your business and minimum anxiety about the future for your people and your customers.

From my work with large and small companies in transition I have seen what leaders do well, what makes a difference to their success, and some of their common mistakes. My forthcoming book Exit Signs explores Transition Leadership in great depth, with worksheets for hands-on planning. If you haven’t signed up for a book release notice, please click here. Meanwhile, here’s a simplified illustration of some of those leadership practices.

In this post, I’ll share these leadership lessons starting with:

What Strong Leaders Do to Transition Their Businesses

Build a Value Improvement Plan

To assure your business is ready to sell, you must take a hard reality check. What drives and what detracts from your business’s value and salability? What’s your plan to maximize its value? Your value-improvement plan is a big part of your exit strategy AND your yearly operations plan. The more these two plans are in sync, the less confusion and conflict for resources. You won’t be hearing, “Are we working on your exit stuff or on our regular work?”

Let your key people know those priorities, and engage them in implementing the plans. It increases their sense of control and builds commitment to changes. They see a road that leads to a stronger future regardless of ownership.

In my former consulting company, we took a hard look at our business and our business processes and found a major area affecting our growth and exit goals: revenue generation—where it came from (geography, type, and size of contracts) and who the rainmakers were. It was clear that we had to make some big, somewhat painful changes. We called them “bridge plans.” They had to get us over three major cracks in our highway to growth and partner exits: account management, compensation, and sales capability.

In my former consulting company, we took a hard look at our business and our business processes and found a major area affecting our growth and exit goals: revenue generation—where it came from (geography, type, and size of contracts) and who the rainmakers were. It was clear that we had to make some big, somewhat painful changes. We called them “bridge plans.” They had to get us over three major cracks in our highway to growth and partner exits: account management, compensation, and sales capability.

Accountability and Consistency

You have to model accountability for completing the transition improvement plans. Exit transition plans can’t be important some of the time. They must consistently be on your operations reviews/staff meeting agenda—not just when you have time for them. Your people know that what you give your time and attention to is what counts, is measured, and is rewarded. If your exit transition tasks lack your consistent attention, they will not get consistent attention from others either.

When you engage your key people in accomplishing the transition tasks, make accountability clear, as well as how you will measure results. Who owns which changes? Who is accountable for which results that improve the value of the business? In any sale process, it’s normal for people to wonder,

“What’s in it for me?” Helping you get the business ready for a sale creates the opportunity to show a shared benefit, whether that is a financial reward or a developmental assignment.

Engage Your Key People in Transition Priorities

In my exit bridge plans, we had to ensure we had revenue continuity with my clients when we left. It was a high risk factor to our growth goals as well. We made revenue retention part of our exit and operations plans, i.e., we tied achievement to partner bonuses. We called it “two faces to the customer.”

We also selected our youngest partner for a stretch assignment: to be joined at the hip with me for our largest customer. For twelve months, she took increasing responsibility for program management and consulting work, living overseas, delivering programs, and working with senior executives.

When I exited my business, I received a wonderful note from the CEO a) thanking me for my work and b) acknowledging the respect he had for the talented new account leader.

You may be thinking, but that’s risky too! Or maybe you’re thinking we could do that because we were a small professional services firm. In fact, the risk to our growth plan if we did nothing was greater than the risk of the development plan failing. Second, stretch assignments in acquisitions and divestiture situations are conducted in the best companies regardless of size. All it takes is clarity in the plan and consistent investment of time and attention—yours.

Remember Your Goal

An important benefit of leading your transition well is that your buyer (whether an internal or external one) sees a company ready for an ownership change minus the traffic jams that many transfers experience. They see transitions being proactively managed, and they see people who are ready to carry on after your departure. That adds value to your business and peace of mind to your buyer.

In my next blog, you will read more about the sticky question of engaging your people, your customers, and your suppliers in your exit transition. It’s a topic debated by owners, advisers, and academics. What do you communicate, to whom, when? How do you weigh the advantages and risks?

What leadership lessons can you pass along to other business owners as they lead their exit transitions? Please leave your lesson below!