It’s a new year, may it be a rewarding one!

What does that mean to you? If you’re a long-time business owner it may mean continued growth and profitability or maybe just a year better than the last. If you’re like 75% of business owners you’re counting on the year ahead to help ensure your future retirement. For a small group of owners it means executing an exit plan that frees them to begin the next chapter. But as I’ve written before, about 85% of small business owners do not have a plan in place to realize those hopes. Recent news and research continues to confirm these statistics and the reasons behind failure to plan: fear of admitting to aging, skepticism with planning for the unknown, and anxiety about impending retirement decisions.

The Big Difference: Mind Set

It’s an exciting time for Boomers. The economy is stronger than in the last decade: retirement accounts and business values are solid. Late-stage owners are using their imaginations to define what’s next, and the options they are imagining aren’t a function of the size of their payout, of economic or family circumstances, or their age upon exit.

Boomers define retirement differently from their parents. Only 14 percent see retirement as a time to “take a well-deserved rest.”[i] Sixty percent of prospective retirees say they view retirement to be “a new, exciting chapter in life” and have aspirations for continuing activity, contribution and satisfaction. They see working in retirement “as a way to contribute, remain stimulated and pay the bills.”[ii] Which view sounds like you?

Snapshots

I used to work with corporate leaders with significant challenges requiring large transformations stemming from shifts in their industry, technology, regulations or markets. The smart leaders worked to create powerful images of a future that would mobilize commitment and compel action for the transition.

I asked these leaders to create snapshots of what they and others would be doing differently — more of and less of — if that transformation were successful. It’s those mental pictures of behavior and activities that brought their aspirations to life and made them practical, do-able and track-able!

This is a useful activity for small business owners too. We need to retrieve snapshots about what we have been most satisfied about in our business journey AND create snapshots about what we most want about the next phase of life’s journey.

Take some time to retrieve and create snapshots about some of the following.

- What have been the shining moments in my business, and what made them so?

- What has given me the greatest fulfillment in my life so far?

- When I look at my calendar for the last two quarters, what activities have been the most satisfying? What items do I wish I didn’t have on my calendar?

- In a more perfect world, what experiments would I take on (outside of work) that would excite me?

- When I listen to my heart, not my head, what does it long for?

What do your answers tell you about:

- What aspects of the past are important to continue i.e. what fuels your energy?

- What might an exploration or experiment consist of?

- What would you enhance about your life going forward?

- What would you begin or renew?

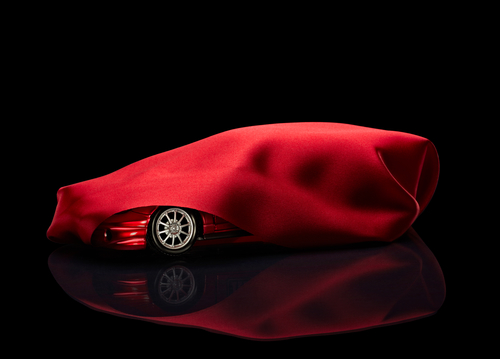

Imagining what’s next doesn’t ignore the past but captures its meaning for planning purposes. And planning is equal parts celebration of the past, imagining the future, and doing the practical analysis of what it will take to move forward. This work focuses our mind’s-eye on the possibilities under that shrouded new vehicle not the image of being put out to the junkyard.

Perhaps most important, those who successfully move forward whether it’s out of a job or selling their companies, overwhelmingly wish they had begun that planning earlier. It’s January, let’s resolve to start this now.